By Kenton X. Chance

Correspondent

KINGSTOWN, St. Vincent and the Grenadines, February 5, 2019 (CMC) – The St. Vincent and the Grenadines government has announced tax increases on gasoline, diesel, tobacco, sweetened drinks and landing fees at the island’s sole international airport.

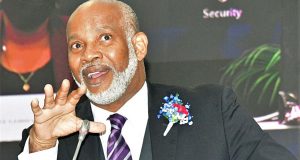

Finance Minister, Camillo Gonsalves, delivering the budget address, late yesterday, less than a week after Parliament gave the nod to the estimates of revenue and expenditure, said that the tax measures will bring in revenue, estimated at eight million EC dollars.

“These modest adjustments further this government’s practice of prudent fiscal management and people-centred budgeting,” Gonsalves said, as he delivered his second budget since becoming Finance Minister in 2017.

He told legislators that the EC$1,067 billion budget represents a 7.4 percent year-on-year increase, and that the hike in the total outlay in 2019 is accounted for, on both the capital and recurrent sides of the fiscal package.

According to the figures presented in Parliament, recurrent expenditure, inclusive of amortisation and sinking fund contributions, is estimated at EC$844.7 million, with capital expenditure of EC$222.5 million.

He said the 20 percent tax on gasoline will result in the commodity being sold at three dollars a gallon, while the 40 percent increase on gas and oils, other than diesel, will allow for the product to be sold, now, at EC$2.10.

“It is important that this revised excise, and, indeed, the price of fuel in St. Vincent and the Grenadines generally remain low, relative to our neighbours in the OECS (Organisation of Eastern Caribbean States),” Gonsalves said, adding that the adjustment is expected to generate an additional EC$4.2 million for the government.

The Finance Minister said the significant increase in the importation of used motor vehicles has given rise to health and environmental concerns, linked to increasing levels of vehicular emissions and increased dumping of derelict vehicles and used parts.

He said that in 2018, the government reduced the age of imported, used vehicles, adding that this is a trend that will continue in the future.

“We cannot continue to spend more in health care to treat respiratory illnesses, such as asthma, which is increasing in prevalence in recent years,” he said, noting that the number of vehicles in the country had grown, exponentially, over the last decade.

Gonsalves said this places tremendous pressure on the road network, hastening the deterioration of the service of the nation’s highways and secondary roads.

The finance minister said there are over 32,000 vehicles on the roads, here, and, notwithstanding the increased government spending on road repairs and rehabilitation, the calls from the public for even more spending on the roads are quite evident.

He said that the excise on petroleum products was in response to these demands for spending on roads, healthcare and environmental protection.

Gonsalves said that the tax on water, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavour, would increase from 10 to 20 percent, while the tax on aerated beverages would also increase by the same margin, resulting in revenue, estimated at EC$2.4 million.

The government also announced a 10.7 percent increase in the tax on alcoholic beverages, including ethyl alcohol, of an alcoholic strength by volume, of 80 percent or higher, while the taxes on brandy, whiskey, gin, vodka and rum in bottles, of strength not exceeding 46 percent volume, will increase by 20 percent.

The government said the tax on cigarettes will increase from EC1.55 to EC$2.75 per 100 sticks, while unmanufactured tobacco, tobacco refuse, the rate will increase from six to 10 percent. The duty on cigars will move from 14 percent to 20 percent.

The excise levied on other manufactured tobacco and tobacco substitutes will move from six to 10 percent. Under the category “other”, the excise moved six percentage points, from 12 percent to 18 percent.

The debate on the budget presentation will began today.

Pride News Canada's Leader In African Canadian & Caribbean News, Views & Lifestyle

Pride News Canada's Leader In African Canadian & Caribbean News, Views & Lifestyle