PORT OF SPAIN, Trinidad (CMC) – The Central Bank of Trinidad and Tobago Friday said that the oil-rich twin island Republic is “officially in a recession” after it failed to post any economic growth for any quarter of 2015.

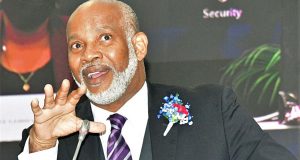

Central Bank Governor, Jwala Rambarran, addressing the Fifth Monetary Policy Forum organised by the Downtown Owners and Merchants, said the country is “facing austere economic circumstances.

“The economic priorities in 2016 must be aimed at supporting a firm enough recovery through appropriate monetary and fiscal policies, setting forth a medium-term framework which balances consuming, saving and investing energy wealth.”

He said that the appropriate monetary and fiscal policies can only come from the Central Bank and the Ministry of Finance working together.

“We have no choice, we can and should work together to ensure we get the policies right for the country’s recovery. We will all be doubled damned if spite, vindictiveness and ego keep us from working together to help our country,” he added.

Rambarran said that the grim reality is that Trinidad and Tobago is in a recession, stuck in a low growth cycle, vulnerable to further declines in energy prices and production.

He said the Central Bank’s short term outlook for 2016 is for continued contraction of the Trinidad and Tobago economy, on the back of a further decline in the energy sector, which will compound sluggishness of the non-energy sector, the country’s external position to come under more pressure;

Central Government’s fiscal deficit to increase from what was budgeted; and public debt to rise as a result of more government borrowing to finance projects.

Rambarran told the Forum that since the release of the Central Bank’s Monetary Policy Report in early June this year, “Trinidad and Tobago’s economic growth prospects remain subdued amid weak business and consumer confidence.

He said following a dismal first half of 2015, domestic economic activity was depressed in the third quarter of this year, and similar weak economic conditions have prevailed so far into the fourth quarter of 2015.

“Four consecutive quarters of decline in real GDP (gross domestic product) in 2015 means Trinidad and Tobago is now officially in a recession,” he said, adding “what brought on this 2015 recession…should not come as a major surprise to many of us”.

Rambarran said prolonged supply disruptions in the energy sector in 2015, continued to result in sharp shortfalls of natural gas production which, in turn, adversely affected output of LNG (Liquefied natural gas) and petrochemicals, including methanol, ammonia, urea, iron and steel.

He told the Forum that lower energy prices also negatively impacted the domestic energy sector. This has already been reflected in job losses at some energy companies. The decision by Arcelor Mittal to idle its steel plant, will not only affect energy output but also jobs,’ he said.

“The non-energy sector, which has kept the economy from veering off its already weak growth trajectory for the past few years, seems to have lost its momentum. Weakness has crept into key sectors such as distribution and construction, following a temporary pick-up in non-energy activity driven by spending in the run-up to the General Elections. The latest Business Confidence Survey suggests optimism waned among the local business community in the third quarter of 2015.”

Rambarran said that on this basis, Central Bank estimates the Trinidad and Tobago economy is likely to contract by 1.5 per cent this year, a reversal of the sluggish but still fairly decent growth of around one per cent in 2014.

“We expect the energy sector to contract by just over 3.5 per cent, while activity in the non-energy sector is expected to be flat in 2015.”

During the campaign for the September 7 general elections here, the Kamla Persad Bissessar-led People’s Partnership government, in the court, had denied any economic slowdown, and accused the then opposition People’s National Movement (PNM) of not having any plan to further improve the economy.

Rambarran said that the word recession “is not the kind of news you want to deliver to the country 19 days before Christmas.

“However, the economic events over the past year should have started sobering, even the most financially nonchalant among us,” he said, adding that the last time the country saw economic performance figures like these was in 2009, a recession which lasted all of one year.

Prior to that, the country experienced a severe recession for seven consecutive years from 1983 to 1989.

He said that the Central Bank’s proactive monetary policy stance is ”a clear example of damned if you do, double damned if you don’t.

“We always have to consider whether to act early or act later. Since September 2014, we started gradually increasing our policy interest rate.

“We believe we must act well in advance, and as much as possible to help insulate the Trinidad and Tobago economy, from the potential disruptive shocks we are expected to feel from rising U.S. interest rates. Close linkages with the United States expose Trinidad and Tobago to fluctuations in U.S. economic activity and changes in U.S. monetary conditions.”

He said the Central Bank’s Monetary Policy Committee (MPC) at its meeting this month, agreed to raise the ‘Repo’ rate by 25 basis points to 4.75 per cent.

“Although this was the eighth consecutive hike in the Repo rate, the MPC still views the monetary policy stance to be accommodative. In fact, we are still far from reaching the neutral policy rate, which is considered neither too restrictive, nor too accommodative.”

He said that the most influential decision driving Central Bank’s monetary policy stance is the forthcoming normalization of U.S. monetary policy.

Rambarran said the US Federal Reserve has delayed the long-awaited increase in its policy interest rate, waiting until the U.S. labour market shows continued strength, accompanied by firm signs that inflation is rising towards its medium term target.

He said, while there is still the possibility for the Fed’s first rate increase since June 2006 to occur before the end of 2015, market opinion remains somewhat divided on its exact timing.

“The Fed’s interest rate lift-off could lead to bouts of market turbulence, and reversals of capital flow in emerging economies, at a time when global financial markets are already volatile owing to uncertainty over China’s growth prospects and falling commodity prices.

“The continuing challenge for monetary policy is to achieve a fine balance, let me stress, an extremely fine balance between insulating the Trinidad and Tobago economy from external shocks and not unduly undermining short term growth.”

He said the MPC had considered delaying further increases to interest rates, adding “this could give the Monetary Policy Committee room to reassess unfolding developments and avoid choking off a possible recovery in the non-energy sector.

“On the other hand, the MPC was of the opinion that delaying further increases to interest rates would require an even stronger monetary policy response in the future, with more severe consequences for short-term growth in the non-energy sector. In other words, move interest rates slow and steady, instead of a big bang.”

He said when the Central Bank started moving interest rates last September, the rate was at three per cent.

“What if we didn’t move then? In order to protect us now, we would have to raise interest rates by at least 100 basis points. Let’s say the Fed announces its rate increase in mid-December at its last meeting of the year, our MPC meets every two months and our next meeting would be at the end of January, two months after the Fed’s hike, and all the financial markets have reacted.

“We would be caught playing serious catch up. Since our rate hikes take about six months to start working its way through the banking system, that means we could have been facing almost a 9-month lag between our increase and the Fed’s.”

The Central Bank governor said that there have been those who have not agreed with the Bank’s position,” a difference of opinion is healthy, but I say to those sitting on the sidelines, don’t be so quick to judge, damning us for our proactive monetary policy.

“Central banking is like perfectly balancing an orange on a pin’s head. It’s not impossible, just nearly. We of all people understand the implications of our decisions and what’s at stake. We are not nonchalant with our country’s economy.”

He warned that, for Trinidad and Tobago, the timing and pace of increases in U.S. interest rates have tremendous implications for portfolio capital outflows, and foreign exchange demand, especially since returns on U.S. dollar asset remain more attractive than Trinidad and Tobago dollar assets.

“Higher domestic interest rates are necessary to enhance returns on TT$-denominated assets, helping to curb portfolio capital movements out of Trinidad and Tobago. Higher domestic interest rates are also necessary, to discourage heavy consumer borrowing on imported consumer durables, which are a major source of foreign exchange demand.

“Higher interest rates are even more important to provide a lifeline to private pension funds, and insurance companies whose investment portfolios have been under tremendous stress, in the prolonged low interest rate environment.”

Pride News Canada's Leader In African Canadian & Caribbean News, Views & Lifestyle

Pride News Canada's Leader In African Canadian & Caribbean News, Views & Lifestyle